Get the free life insurance beneficiary form template

Show details

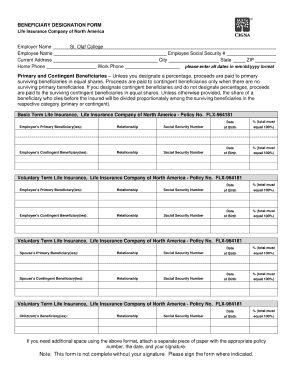

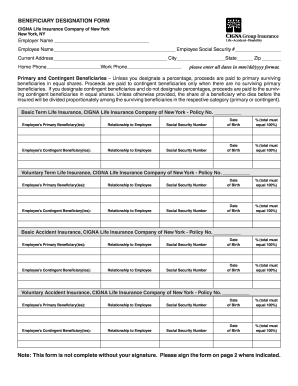

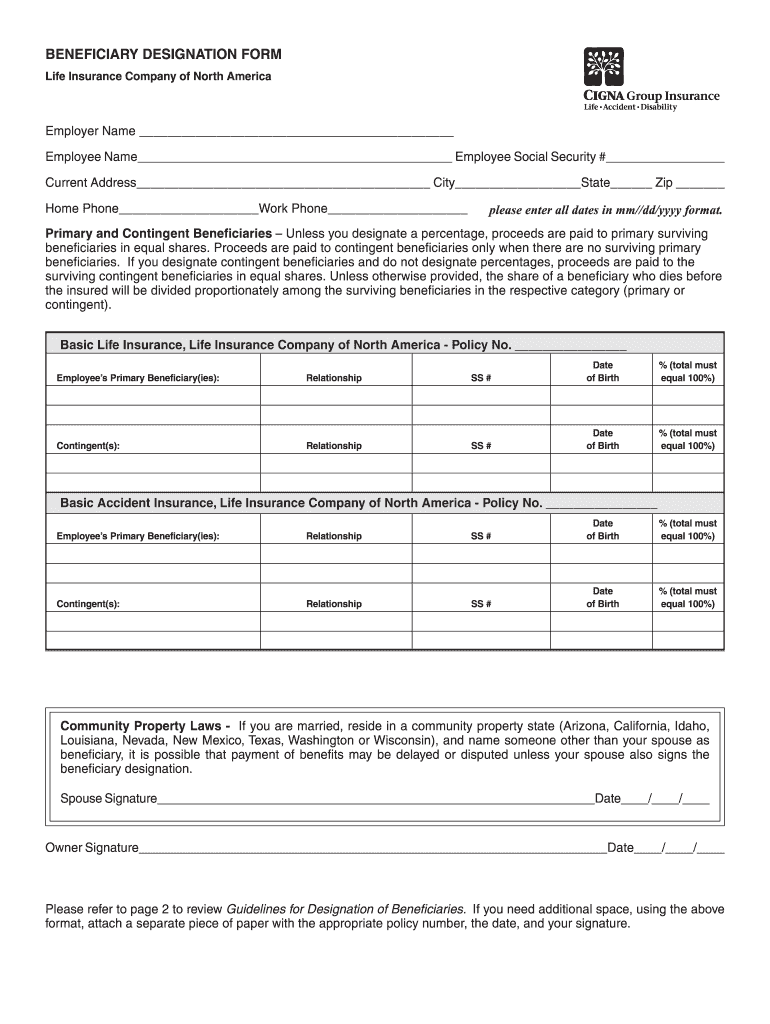

BENEFICIARY DESIGNATION FORM Life Insurance Company of North America Group Insurance Life Accident Disability Employer Name Employee Social Security # Current Address City State Zip Home Phone Work

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your life insurance beneficiary form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance beneficiary form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance beneficiary form template online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit printable beneficiary forms. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out life insurance beneficiary form

How to fill out life insurance beneficiary form?

01

Gather necessary information: Start by collecting essential details such as your full name, contact information, policy number, and the policyholder's information.

02

Identify the beneficiaries: Determine the individuals or entities you wish to designate as beneficiaries. Ensure you have their full names, addresses, and relationship to the policyholder.

03

Specify the percentage or amount: Indicate the allocation of policy proceeds among the beneficiaries. You can either assign a fixed percentage or a specific amount to each beneficiary.

04

Consider contingent beneficiaries: It is recommended to name contingent beneficiaries in case the primary beneficiaries pass away before you. List their information as well.

05

Review and update regularly: Regularly review and update your life insurance beneficiary form to reflect any changes in your beneficiaries' circumstances or relationships.

Who needs life insurance beneficiary form?

01

Anyone with a life insurance policy: Whether you have a term life insurance policy, whole life insurance policy, or any other type of life insurance, you will have to designate beneficiaries.

02

Policyholders who want control over the distribution of funds: By filling out a life insurance beneficiary form, you have the ability to specify exactly who will receive the policy proceeds in the event of your passing. This ensures your wishes are upheld.

03

Individuals with multiple beneficiaries: If you have different individuals or entities you wish to leave proceeds to, a beneficiary form allows you to assign specific percentages or amounts to each beneficiary, ensuring a fair distribution.

04

Those who want to provide for their loved ones: By designating beneficiaries, you are making sure that your loved ones are financially supported and protected after your passing.

05

People who want to avoid complications and disputes: A properly completed beneficiary form can help avoid potential disagreements or legal complications among family members or other interested parties by explicitly stating your wishes.

Fill winco life insurance forms for beneficiary : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is life insurance beneficiary form?

A life insurance beneficiary form is a document that allows the policyholder to specify who will receive the death benefit from their life insurance policy upon their death. The beneficiary can be a person, multiple people, a trust, or an organization. The form typically requires the beneficiary's name, contact information, relationship to the policyholder, and the percentage of the death benefit they are entitled to receive. It is important to regularly review and update this form to ensure that it reflects the policyholder's current wishes.

Who is required to file life insurance beneficiary form?

The policyholder, who is the owner of the life insurance policy, is required to file the life insurance beneficiary form. This form allows the policyholder to designate who will receive the insurance policy's death benefit upon their passing. It is important to keep this form updated and review it periodically, especially in the event of any life changes, such as marriage, divorce, or the birth or adoption of a child.

How to fill out life insurance beneficiary form?

Filling out a life insurance beneficiary form is typically a straightforward process. Here are the steps you can follow:

1. Obtain the beneficiary form: Contact your life insurance provider or visit their website to obtain the beneficiary form. You may also receive this form when you initially purchase the policy.

2. Review the instructions: Read the instructions provided with the form carefully. This will help you understand the requirements and specific details required to complete the form.

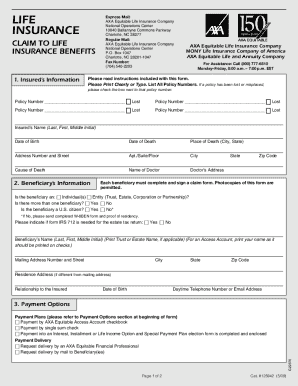

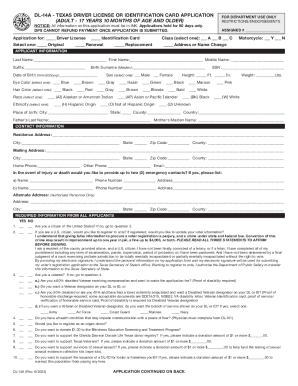

3. Provide personal information: You will need to provide personal information about yourself, the policyholder, and beneficiaries. This may include names, addresses, dates of birth, and social security numbers.

4. Specify the percentage or amount: Indicate how the death benefit should be divided among multiple beneficiaries. You can assign a specific percentage or allocate a specific dollar amount to each beneficiary. Ensure the total percentages or amounts add up to 100%.

5. Consider contingencies: If you want to designate secondary or contingent beneficiaries, this is the place to do so. These are individuals who will receive the benefits if the primary beneficiaries pass away before the policyholder.

6. Review and sign: Once you have filled out the form, carefully review all the information entered to ensure accuracy. Ensure that all required fields are completed properly. Finally, sign and date the form, as required.

7. Submit the form: Send the completed and signed beneficiary form to your life insurance company. You may need to mail it to the address provided or submit it electronically through their website. Be sure to follow the instructions exactly to ensure proper submission.

It's important to note that laws and requirements may vary by country and insurance provider. If you have any doubts or questions, it's recommended to consult with your insurance agent or an attorney for guidance.

What is the purpose of life insurance beneficiary form?

The purpose of a life insurance beneficiary form is to designate who will receive the death benefit proceeds from a life insurance policy when the policyholder passes away. This form allows the policyholder to specify one or more individuals, organizations, or entities as beneficiaries and determine the percentage or amount each beneficiary will receive. The beneficiary form ensures that the policyholder's wishes regarding the distribution of the policy proceeds are honored and provides clarity to the insurance company regarding the intended recipients.

What information must be reported on life insurance beneficiary form?

The information required on a life insurance beneficiary form typically includes:

1. Policyholder Information: Full name, address, and contact details of the person who owns the life insurance policy.

2. Beneficiary Information: Full name, relationship to the policyholder, date of birth, and contact details (address, phone number, email) of the person(s) designated as beneficiary.

3. Social Security Number: The Social Security Number (SSN) or Taxpayer Identification Number (TIN) of the beneficiary may be required for identification purposes.

4. Percentage of Benefit: The beneficiary form usually asks for the percentage of the death benefit that each beneficiary should receive. It is optional to specify the percentage; otherwise, the benefits may be distributed equally among the designated beneficiaries.

5. Contingent Beneficiary: In case the primary beneficiary predeceases the policyholder, it is common to designate a contingent beneficiary who would receive the benefits. Their information (name, address, contact details, etc.) may be required as well.

6. Signature and Date: The form requires the signature of the policyholder and the date of completion to establish the authenticity and agreement of the information provided.

It is important to note that the requirements for life insurance beneficiary forms may vary between insurance companies or jurisdictions. Therefore, it is advisable to check the specific instructions provided by the insurer.

What is the penalty for the late filing of life insurance beneficiary form?

The penalty for the late filing of a life insurance beneficiary form can vary depending on the insurance company and specific policy provisions. In some cases, there may not be a direct financial penalty, but the delayed processing of the beneficiary form could result in a delay of the payout of the life insurance benefits to the intended beneficiaries. It is important to review the policy documents and contact the insurance company directly to understand any potential penalties or consequences for late filing.

How do I make changes in life insurance beneficiary form template?

With pdfFiller, the editing process is straightforward. Open your printable beneficiary forms in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the beneficiary form template electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your cigna beneficiary designation form in seconds.

How do I fill out the cigna beneficiary designation form on my smartphone?

Use the pdfFiller mobile app to complete and sign cigna life insurance beneficiary form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your life insurance beneficiary form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Beneficiary Form Template is not the form you're looking for?Search for another form here.

Keywords relevant to cigna life beneficiary designation form

Related to cigna life beneficiary form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.